Second Order Charts

RitchViewer allows you to look at data in a different way.

Microsoft, Google and other third party products supply charts that present the raw data. At RitchViewer we focus on the results needed for analytics and insights.

Growth

When you look at Sales or Revenue, you don't just want to see a chart of those numbers, you also want to see how the Sales are growing.

In this example RitchViewer supplies the raw 'Total New Plane Revenue' data in column format but just as importantly a line chart associated with the secondary axis showing growth in Revenue year-on-year.

Historic Average Versus Forecast

When you look at ratios you want to see historic averages against forecast. In the finance industry, this means any sort of margin, such as EBIT Margin shown in the image. It could equally apply to Payout Ratio, Debt/Equity, Capex/Sales or Capex/Depreciation.

See in the chart on the right how their is a step up in historic 'EBIT Margin' versus forecast. A good Analyst would ask 'Why?' Is this a model issue or a structural change?

Step Charts

Their are a multitude of reasons for wanting to see incremental movements between data points. One of the tools to do this is the step chart. In the finance industry a common set of metrics for this type of chart would be Return on Assets, Return on Equity, or Return on Capital Employed. In this example, we are showing the same data as in the previous growth chart to allow you to compare the different chart attributes.

Change in Value

Again, using the 'Total New Plane Revenue' data, we can look at the absolute change in value between each period. In this case we are not seeing what the absolute 'Plane Revenue' is, but the dollar value between each year. So in 2012 we saw the largest increase in Revenue occur. What is more, there was not a corresponding decline in 2013, so that step up in Revenue seems to be structural / permanent. As an Analyst, you can then ask the question Why?

Change in Percent

This chart is the same data as in the 'Change in Value' chart, but we get to see percentage change. What you saw in the last chart was that 2012 had the largest step up in Revenue, but was it the biggest movement for the company? The answer is no. Although with an absolute value of $7.9b (which is less than $13.2b in 2012), in 2006 we saw a 46.5% change in Revenue over the 42.8% change in 2012. Of course the second point of interest is the negative change two years later in 2008. Will that pattern repeat or was that just a result of the Global Financial Crisis (GFC)?

Compounding and Accumulating

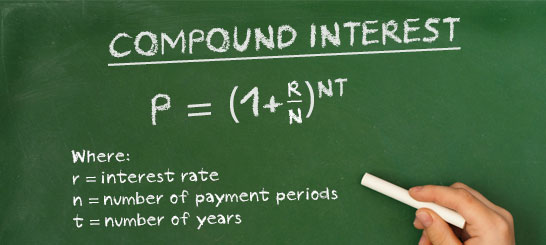

Sometimes you are give percentage data, which accumulates year-on-year. You cannot just add the percentage up as they build on each other, you need to compound them.

Alternately you might be given data that accumulates over time, like monthly sales - so you want to see a chart that build on these sales month-by-month.

In the following video, you see examples of both compounding and accumulating second order charts along with the alternative way (proof) of achieving the same outcome in a spreadsheet. You can see in the video that within RitchViewer, you just click on the data and choose the compound line chart to instantly visualize compounding growth over the supplied years. This can of course also be done on the spreadsheet, so we have also recreated what you would need to do to get the same results from Microsoft Excel, Google Sheets, or Apple Numbers - effectively applying the formula on the chalk board for each period in consecutive cells.

Similarly, if you had say monthly sales and you wanted to see how these sales accumulates over time, then with one-click RitchViewer can do just that. Again, we have recreated what needs to be done on a spreadsheet to get the same results.

In both cases you would need to create a second order series on the spreadsheet, calculate the results, then graph them.

Seasonality

When looking at time-series data, you want to be able to compare year against year. Am I seeing the same pattern in monthly sales from a retail store? Are airline passenger load factors seasonal, and if so what should we expect in the coming months?

This chart shows a two year cycle of passenger load factors for Cathay Pacific on their "South East Asia & Middle East" route. Looking at the data, we only have load factors out to September in 2014. Assuming 2013 (blue chart) is a typical year, then this chart gives us an indication of what to expect in the following months in 2014.

We can of course add more years to see if there is a consistent pattern of upward passenger load factors in the quarter between September and December each year.

Fast Fact

RitchViewer has many more Second Order charts and they are growing. We will leave you with a video of how you might examine a balance sheet using a concept we call Pivot Row.

In the video below, we have set "Total Assets" as our Pivot Row. What this means is that when we look at other rows in the same block, each will be presented as a percentage of "Total Assets". In accounting, this would be called a common size or base 100 balance sheet.

The video starts out showing the focus row's data on the left axis as a column chart with the a line chart of the <focus row> / "Total Assets" against the right-axis. We then swipe between the charts to show a second order chart which doesn't show original data at all. It shows columns of the <focus row> as a percentage of "Total Assets"; plus lines indicating the average historic and average forecast of the <focus row> / "Total Assets". For the layman, the chart allows you to see where the movements in Assets occur across time, and answer questions like "Are the people who owe me money taking up more of my Balance sheet resources?", "Are my Fixed Assets growing relative to the rest of my Balance Sheet?"